Benchmark Reports A Deep Dive

Benchmark reports offer a crucial framework for understanding performance and identifying areas for improvement. This deep dive into benchmark reports will explore everything from defining them to using them for strategic decision-making. We’ll dissect the components, data collection methods, presentation strategies, and best practices to create impactful reports. The focus is on leveraging benchmark reports to make informed decisions across various industries.

We’ll examine the essential components of a well-structured benchmark report, including clear and concise language, accurate data presentation, and impactful visualizations. Different types of benchmark reports (financial, operational, customer satisfaction) will be discussed, along with the industries where they are commonly used. We’ll also explore the challenges in benchmarking and strategies to overcome them.

Defining Benchmark Reports

Benchmark reports are crucial tools for organizations seeking to understand their performance relative to industry standards and best practices. They provide a framework for evaluating strengths, weaknesses, and opportunities for improvement across various operational aspects. These reports, often based on extensive data collection and analysis, offer a structured method for identifying areas where processes can be optimized and resources allocated effectively.Benchmarking allows businesses to identify best-practice models and adopt them to enhance efficiency and effectiveness.

The insights derived from these reports can fuel strategic decision-making, leading to improved competitiveness and profitability. This structured approach to performance evaluation empowers organizations to understand their place within the competitive landscape and take targeted steps to elevate their position.

Types of Benchmark Reports

Benchmark reports encompass a wide range of categories, reflecting the diverse facets of organizational performance. They can analyze financial performance, operational efficiency, customer satisfaction, and even employee productivity. Each type provides specific insights into different areas of the business, allowing for a holistic understanding of the company’s overall standing.

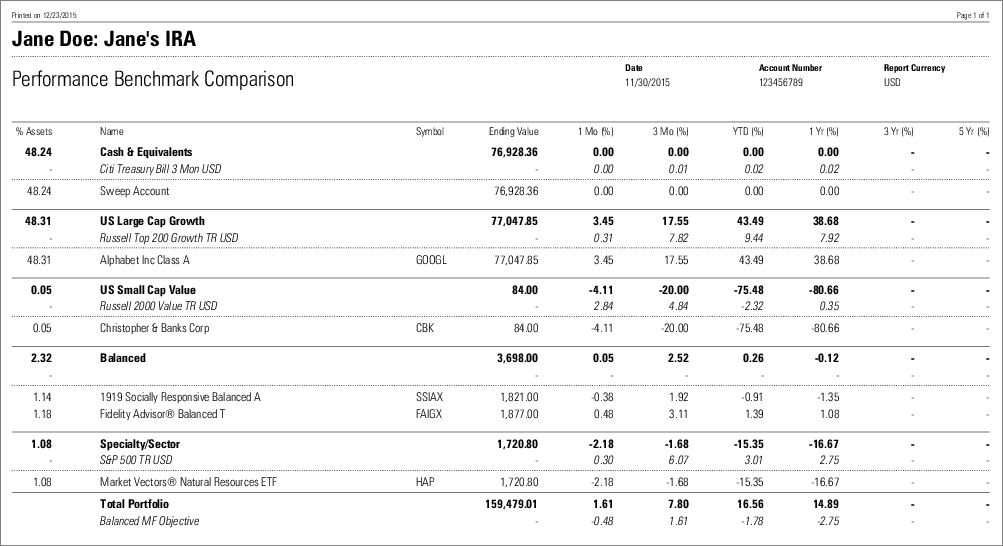

Financial Benchmark Reports

These reports focus on financial metrics like revenue, profitability, and return on investment. They compare a company’s financial performance to industry averages or competitors. This allows for identification of strengths and weaknesses in generating revenue and controlling costs. Financial reports often incorporate key ratios, such as profit margins and debt-to-equity ratios, to evaluate the company’s financial health against industry benchmarks.

For instance, a retail company might benchmark its profit margins against other retailers in the same sector, uncovering opportunities to optimize pricing strategies.

Operational Benchmark Reports

These reports delve into the efficiency and effectiveness of internal processes. Areas like supply chain management, inventory control, and order fulfillment are scrutinized. By comparing operational metrics across industries, companies can identify best practices in managing resources and improving processes. A manufacturing company, for example, might benchmark its production cycle time against leading competitors, identifying areas for improvement in streamlining the production process.

Customer Satisfaction Benchmark Reports

Customer satisfaction reports assess the level of satisfaction among customers. These reports often involve gathering customer feedback through surveys, reviews, or online ratings. Companies can use this information to compare their customer satisfaction scores against industry benchmarks, identifying areas where their customer service could be enhanced. For example, a hospitality company could benchmark its customer satisfaction scores against competitors in the same region, focusing on enhancing service delivery based on the insights gained.

Industries Utilizing Benchmark Reports

Benchmark reports are widely used across various industries. These reports offer invaluable insights into industry trends and best practices. From manufacturing to healthcare, finance to retail, companies leverage these reports to optimize operations and improve overall performance.

Examples of Benchmark Reports Across Different Sectors

Examples include a manufacturing company benchmarking its production cycle time against industry leaders to streamline operations; a financial institution evaluating its return on assets against competitors to assess profitability; and an e-commerce business comparing its customer satisfaction scores against industry averages to enhance customer service.

Comparison of Different Types of Benchmark Reports

| Type of Report | Focus Area | Key Metrics | Typical Usage |

|---|---|---|---|

| Financial | Revenue, profitability, ROI | Profit margin, return on equity, debt-to-equity ratio | Evaluating financial health, identifying investment opportunities |

| Operational | Efficiency of internal processes | Cycle time, inventory turnover, order fulfillment rate | Streamlining operations, optimizing resource utilization |

| Customer Satisfaction | Customer experience | Customer satisfaction scores, Net Promoter Score (NPS), customer feedback | Improving customer service, identifying areas for improvement |

Components of a Benchmark Report

Benchmark reports provide a crucial comparison of performance against established standards or industry best practices. They are essential tools for organizations seeking to identify areas for improvement, enhance operational efficiency, and ultimately achieve higher levels of success. A well-constructed benchmark report is more than just a collection of data; it’s a roadmap for informed decision-making.A comprehensive benchmark report necessitates a clear understanding of the key performance indicators (KPIs) being measured, the specific data sources, and the methods used for analysis.

It’s critical to maintain a focus on actionable insights, allowing the report to serve as a valuable resource for identifying areas requiring attention and guiding strategic initiatives.

Benchmark reports are crucial for understanding where you stand in the industry. To really maximize their value, however, you need a well-structured content calendar to help guide your strategy. This means planning your content creation, scheduling it effectively, and ensuring it aligns with your goals, like how to create a content calendar how to create a content calendar.

Ultimately, a solid content calendar will ensure your benchmark reports are even more insightful, allowing you to see clear trends and improvements over time.

Essential Components

A robust benchmark report should encompass several key elements to ensure its effectiveness. These elements contribute to the report’s clarity, accuracy, and ultimately, its usefulness. Clear and concise language facilitates understanding, while accurate data presentation ensures credibility.

- Executive Summary: This concise overview provides a high-level summary of the key findings, highlighting the most important conclusions and recommendations. It serves as a quick reference for busy executives and decision-makers.

- Introduction: The introduction establishes the context of the benchmark report, clearly defining the purpose, scope, and methodology used for data collection and analysis. It also sets the stage for understanding the findings and their implications.

- Methodology: A detailed description of the data collection and analysis process employed in the report. This includes specifics on the data sources, the selection criteria used, and any limitations or assumptions made. Transparency in methodology is crucial for ensuring the reliability and validity of the results.

- Data Presentation: This section showcases the collected data in a structured and easily understandable format. Charts, graphs, and tables effectively present complex data points, allowing for quick interpretation and identification of patterns and trends.

- Benchmark Comparison: This section directly compares the performance of the subject entity (e.g., a company, a department) with the benchmark standards. The comparison is typically presented in a clear, easily digestible manner, highlighting key differences and similarities.

- Analysis and Interpretation: This section delves into the analysis of the benchmark data. It identifies trends, patterns, and key takeaways, highlighting areas of strength and weakness. The analysis also identifies potential areas for improvement and suggests specific strategies for enhancement.

- Recommendations: Based on the analysis, this section proposes concrete recommendations for action. It Artikels specific steps that can be taken to address identified weaknesses and capitalize on strengths, ensuring that the report directly translates into actionable strategies.

- Conclusion: This section summarizes the main findings and recommendations. It provides a concise recap of the key takeaways from the benchmark report and underscores its overall significance.

Importance of Clear and Concise Language

Clear and concise language in a benchmark report is essential for effective communication. Vague or overly technical language can obscure the meaning and lead to misinterpretations. Precise language choices contribute to the report’s accessibility and clarity. This allows stakeholders to readily understand the findings and apply them appropriately.

Significance of Accurate Data Presentation

Accurate data presentation is crucial for building trust and credibility in a benchmark report. Inaccuracies in data representation can undermine the validity of the entire report. Precise and reliable data, presented in an understandable format, supports informed decision-making and fosters a strong foundation for future strategic initiatives. The report should accurately reflect the data collected and avoid any misleading representations.

Role of Visualizations

Visualizations, such as charts and graphs, significantly enhance the comprehension of benchmark reports. Visual representations of data allow for rapid identification of trends, patterns, and outliers. These visual aids facilitate the interpretation of complex data sets, making the report more engaging and accessible. For example, a bar chart can easily compare sales figures across different regions, while a line graph can illustrate the growth of a specific metric over time.

Key Elements and Significance

| Key Element | Significance |

|---|---|

| Executive Summary | Provides a concise overview of key findings and recommendations. |

| Introduction | Sets the context and clarifies the report’s purpose and scope. |

| Methodology | Ensures the reliability and validity of the results by detailing the data collection and analysis process. |

| Data Presentation | Presents data in a structured, understandable format, enhancing comprehension. |

| Benchmark Comparison | Directly compares performance against established benchmarks, highlighting key differences and similarities. |

| Analysis and Interpretation | Analyzes the benchmark data, identifies trends, and highlights areas for improvement. |

| Recommendations | Provides actionable steps to address weaknesses and capitalize on strengths. |

| Conclusion | Summarizes key findings and recommendations, emphasizing the report’s overall significance. |

Data Collection and Analysis in Benchmark Reports

Benchmark reports rely heavily on the quality and rigor of data collection and analysis. Accurate data is crucial for identifying meaningful trends, patterns, and actionable insights. This process involves careful selection of methods, meticulous data validation, and insightful analysis to ensure the report’s value and credibility. The strength of a benchmark report often hinges on the robust methodology employed in these stages.

Data Collection Methods

The success of a benchmark report hinges on the selection of appropriate data collection methods. Choosing the right method ensures the data accurately reflects the intended scope and provides meaningful comparisons. Different approaches are suitable for various types of benchmark reports, each with its own advantages and limitations.

- Surveys: Surveys are a widely used method for collecting data from a large number of respondents. They can efficiently gather quantitative and qualitative data on various aspects of a subject. For example, a survey can be administered to employees to gauge their satisfaction with company policies, or to customers to assess their experiences with a product.

- Interviews: Interviews offer an in-depth understanding of perspectives and experiences. They allow for open-ended questions and follow-up probing, enabling researchers to gather nuanced information. For instance, in-depth interviews with industry experts can provide valuable insights into emerging trends and best practices.

- Observations: Observations provide a direct view of processes or behaviors. This method is effective in capturing real-time actions and can be particularly useful for understanding operational procedures. For example, observing customer interactions in a retail store can reveal areas for improvement in customer service.

- Document Analysis: Examining existing documents, such as reports, records, and manuals, is a cost-effective way to gather historical data and context. This method is valuable for understanding past performance, trends, and regulatory compliance. For example, reviewing a company’s annual reports allows for a comprehensive view of its financial performance.

- Publicly Available Data: Leveraging publicly accessible data, such as industry reports, government statistics, and market research data, can significantly reduce research costs. This method can provide valuable context and comparisons to industry benchmarks. For example, using data from industry associations can help determine if a company is performing within the industry norm.

Data Validation and Accuracy

Ensuring data accuracy is paramount in benchmark reports. Inaccurate or unreliable data can lead to misleading conclusions and ineffective strategies. Robust validation processes are essential to maintain the integrity of the report.

- Data Cleaning: Identifying and correcting errors or inconsistencies in collected data is essential. This includes handling missing values, outliers, and duplicates to ensure data integrity.

- Verification and Triangulation: Verifying data from multiple sources and comparing findings to ensure consistency and reduce biases is a critical step. This process of triangulation confirms data accuracy.

- Data Quality Checks: Implementing data quality checks at each stage of the data collection and analysis process, such as using validation rules, can help to identify and rectify potential errors before they propagate.

Data Analysis Techniques

Analyzing collected data is crucial for identifying trends and patterns. Different analytical techniques are suitable for different types of data and objectives.

- Descriptive Statistics: Summarizing and describing data using measures such as mean, median, mode, and standard deviation provides a clear overview of the collected data.

- Statistical Modeling: Applying statistical models to identify correlations, causal relationships, and predictive patterns within the data can lead to more insightful interpretations and forecasts.

- Comparative Analysis: Comparing the collected data to benchmarks or industry standards helps to determine where a company stands relative to its competitors or industry peers.

Data Collection Methods and Suitability

| Data Collection Method | Suitable Benchmark Report Type | Explanation |

|---|---|---|

| Surveys | Employee satisfaction, customer experience, market research | Gathers large-scale quantitative and qualitative data |

| Interviews | Expert opinions, in-depth case studies | Provides nuanced insights and deeper understanding |

| Observations | Operational processes, customer interactions | Captures real-time behaviors and actions |

| Document Analysis | Historical performance, regulatory compliance | Provides context and insight into past trends |

| Publicly Available Data | Industry comparisons, market analysis | Provides context and benchmarks against external data |

Presenting Benchmark Report Findings

A well-presented benchmark report is key to its effectiveness. Simply dumping data isn’t enough. Clear, concise visuals and a narrative approach are crucial for stakeholders to grasp the insights and act on them. This section delves into crafting compelling presentations that transform raw data into actionable knowledge.Effective presentation goes beyond just showing numbers. It’s about storytelling, highlighting key takeaways, and translating complex data into easily digestible insights for various audiences.

The goal is to leave a lasting impact and drive positive change.

Visual Representations of Benchmark Data

Visual representations are essential for conveying benchmark data effectively. Different types of charts and graphs can highlight various aspects of the data. The choice of visual should be aligned with the message you want to convey.

- Bar Charts: Excellent for comparing performance across different categories or time periods. For example, a bar chart comparing the average customer satisfaction scores of different departments can quickly reveal areas needing improvement. A bar chart comparing sales figures across regions highlights sales performance variations.

- Line Charts: Ideal for showcasing trends over time. A line chart tracking customer churn rate over the past year can reveal patterns and potential issues. Illustrating website traffic growth over a period reveals the effectiveness of marketing campaigns.

- Scatter Plots: Helpful for identifying correlations between two variables. A scatter plot showing the relationship between customer lifetime value and the average order value can help in strategic decision-making. Scatter plots can illustrate the correlation between employee training hours and project completion times.

- Pie Charts: Useful for representing proportions or percentages within a whole. A pie chart showing the distribution of customer segments across various demographics helps in understanding the customer base better. A pie chart depicting the breakdown of marketing budget across different channels reveals where resources are allocated.

Storytelling in Benchmark Reports

Benchmark reports are more engaging when presented as a story. Weaving a narrative around the data helps create a connection with the audience and make the findings more relatable. Instead of just presenting the data, tell a story about the challenges, successes, and implications of the findings.

- Contextualize the Data: Explain why the benchmark was performed, who it’s for, and what the desired outcome is. By framing the data within a context, the audience understands the importance and relevance of the findings.

- Highlight Key Events: Include events that influenced the data and highlight how they impacted the results. Illustrate how a specific event led to a significant improvement or setback. For example, a sudden surge in website traffic after a marketing campaign.

- Use Anecdotes and Examples: Support your findings with real-life examples or anecdotes to illustrate the impact of the benchmarks. Use specific examples of companies that have implemented similar changes and the positive outcomes.

Highlighting Key Takeaways and Conclusions

Summarizing the key findings and drawing conclusions from the benchmark data is crucial. This section should clearly articulate the implications of the findings and suggest actionable steps for improvement.

- Clearly State Key Takeaways: Identify the most significant insights from the benchmark report. These are the core messages that the audience should take away.

- Present Actionable Recommendations: Suggest specific steps based on the findings to improve performance. Provide practical solutions for implementation. Provide suggestions on how to utilize the data in the organization.

- Concisely Summarize Conclusions: Summarize the overall conclusions based on the data analysis and the recommendations. Conclude with a summary of the implications and implications of the data.

Visual Presentation Methods

| Presentation Method | Strengths |

|---|---|

| Bar Charts | Excellent for comparing categories, easy to understand trends. |

| Line Charts | Effective for showing trends over time, highlighting growth or decline. |

| Scatter Plots | Useful for identifying correlations and patterns between variables. |

| Pie Charts | Good for showing proportions and percentages, clear representation of distribution. |

Utilizing Benchmark Reports for Decision-Making

Benchmark reports, when properly analyzed and understood, offer a powerful toolkit for strategic decision-making. They provide valuable insights into industry best practices and performance, enabling organizations to identify areas for improvement and adjust their strategies accordingly. This is crucial in today’s competitive landscape, where staying ahead of the curve requires a constant evaluation of performance and adaptation to emerging trends.Benchmark reports aren’t just static snapshots; they are dynamic tools that fuel strategic decision-making.

They help businesses not only understand their current standing but also project future performance and adapt to changing market conditions. By comparing their own data with industry averages and top performers, organizations can identify strengths, weaknesses, and opportunities for improvement.

Strategic Decision-Making Support

Benchmark reports facilitate strategic decision-making by providing a comparative analysis of performance metrics. This allows businesses to identify areas where they excel and pinpoint areas needing improvement. By understanding the best practices of their peers, organizations can refine their strategies and optimize resource allocation. This competitive analysis fosters a data-driven approach to decision-making, minimizing the impact of subjective judgments and maximizing the likelihood of successful outcomes.

Identifying Areas for Improvement

Benchmark reports offer a structured method for identifying areas for improvement. By comparing performance indicators to industry averages or best-practice benchmarks, companies can pinpoint gaps in their processes, systems, or strategies. For example, a retail company might discover that their customer service response times are significantly slower than industry leaders. This information prompts a detailed investigation into the factors contributing to the discrepancy, potentially revealing inefficiencies in the current customer support system.

Benchmark reports are crucial for understanding industry performance, but diving deeper reveals more. Industry experts, like those featured in industry experts reveal secrets to building their online business , often share valuable insights into successful strategies. Ultimately, these reports help us identify best practices and tailor our own online business models to achieve optimal results.

Further analysis could identify areas where training, technology, or workflow improvements could lead to significant enhancements in customer satisfaction.

Examples of Influenced Business Strategies

Numerous examples demonstrate the impact of benchmark reports on business strategies. A manufacturing company, noticing a high defect rate compared to industry benchmarks, might invest in new quality control procedures or employee training programs. A software development firm, realizing its development cycles are longer than those of leading competitors, might adopt agile methodologies or improve its project management processes.

These examples highlight how benchmark reports can act as catalysts for strategic adjustments, resulting in tangible improvements in performance and competitiveness.

Acting on Insights from Benchmark Reports

Acting on the insights gleaned from benchmark reports is crucial for achieving tangible results. A passive review of the data will yield minimal benefits. Companies must actively implement changes based on the identified gaps. This involves a comprehensive analysis of the underlying causes, development of a clear action plan, and a robust system for tracking progress and measuring results.

Benchmark reports are crucial for measuring campaign success, but they’re only half the story. To truly understand how your digital PR campaign is performing, you need to look at the bigger picture. A well-executed digital pr campaign will have clear goals and measurable results that can be tracked and analyzed in your benchmark reports. Ultimately, these reports provide valuable insights to help you optimize future campaigns for better results.

This iterative approach to improvement ensures that any implemented changes are monitored and adapted as needed.

Considering External Factors in Data Interpretation

It is imperative to consider external factors when interpreting benchmark report data. Industry-wide economic downturns, technological advancements, or changes in consumer preferences can all influence performance metrics. For instance, a company might find its sales figures lower than the industry average, but upon further investigation, discover that the entire market segment experienced a decline due to a major economic downturn.

Failing to account for these external factors can lead to misinterpretations and potentially flawed strategies. A holistic view of the market context is essential for effective interpretation of benchmark report data.

Best Practices for Benchmark Report Creation

Crafting effective benchmark reports requires a meticulous approach. These reports are valuable tools for organizations seeking to understand their performance relative to industry peers. A well-structured report not only identifies strengths and weaknesses but also provides actionable insights for improvement. Adhering to best practices ensures the report’s clarity, accuracy, and usefulness.

Defining a Clear Scope

A well-defined scope is crucial for a successful benchmark report. Without a clear scope, the report risks becoming overly broad and losing focus. A narrow, well-defined scope ensures that the data collected and analyzed are relevant and contribute meaningfully to the report’s objectives. This focused approach allows for a deeper understanding of the specific areas being benchmarked, leading to more precise and actionable insights.

For example, if benchmarking customer satisfaction, a report focused solely on online customer interactions would yield more meaningful insights than a report attempting to cover all customer touchpoints.

Importance of Consistent Reporting Methodologies

Consistency in methodology is paramount for ensuring the reliability and validity of benchmark reports. Inconsistency in data collection and analysis methods can lead to inaccurate comparisons and misleading conclusions. Standardized procedures for data gathering, data entry, and analysis processes are vital for maintaining accuracy. This consistency allows for apples-to-apples comparisons between different organizations, enabling more accurate conclusions about performance differences.

Using different survey questions or calculation methods for similar metrics will render the comparison invalid and reduce the report’s value.

Examples of Good and Bad Benchmark Report Practices

Good benchmark reports are characterized by clarity, conciseness, and actionable insights. They effectively communicate key findings and offer suggestions for improvement. Conversely, poor benchmark reports often suffer from ambiguity, lack of context, and an absence of actionable recommendations. For instance, a good report might include specific recommendations for process improvements based on the analysis of customer service response times.

A poor report might simply present data without any explanation or interpretation, rendering it useless.

- Good Practice: A report clearly defines the metrics used, providing a detailed explanation of each metric and its significance. This ensures that the reader understands the context of the data presented and the meaning behind the numbers.

- Bad Practice: A report presents raw data without any context or interpretation. The reader is left to deduce meaning on their own, potentially leading to misinterpretations and a lack of actionable insights.

- Good Practice: A report includes a detailed methodology section, explaining the data collection process, analysis techniques, and any limitations of the study. This transparency builds trust and allows readers to assess the validity of the findings.

- Bad Practice: A report lacks a methodology section, making it difficult to assess the reliability and validity of the data. Without a clear understanding of how the data was collected and analyzed, readers cannot evaluate the report’s accuracy.

Summary of Best Practices

| Best Practice | Explanation |

|---|---|

| Clear Scope Definition | A well-defined scope ensures the report focuses on relevant metrics and avoids ambiguity. |

| Consistent Methodology | Standardized data collection and analysis methods maintain accuracy and facilitate meaningful comparisons. |

| Data Visualization | Clear and concise visuals (charts, graphs) enhance understanding and highlight key trends. |

| Actionable Insights | The report should offer concrete recommendations for improvement based on the benchmark results. |

| Transparency and Documentation | A detailed methodology section and data sources build trust and credibility. |

Benchmarking across Different Metrics: Benchmark Reports

Benchmarking isn’t a one-size-fits-all exercise. To gain truly insightful comparisons, you need to consider a multitude of metrics. A single, isolated metric can offer a narrow perspective, potentially masking critical aspects of performance and hindering accurate conclusions. A comprehensive approach, incorporating various relevant data points, allows for a more nuanced understanding of your organization’s standing relative to others.A robust benchmarking process considers the entire landscape of performance indicators, not just the ones that seem most obvious.

This multi-faceted approach reveals patterns and trends that might be missed by focusing on a single metric. It’s crucial to carefully select metrics that align with your specific goals and objectives, allowing for a more precise and meaningful comparison.

Selecting Relevant Metrics for Benchmarking

Choosing the right metrics is pivotal to a successful benchmarking exercise. Metrics must be directly related to the key aspects of your organization’s performance that you wish to improve. Consider the following factors when making your selection:

- Alignment with Strategic Goals: Metrics should directly reflect your organization’s strategic objectives. If your goal is to enhance customer satisfaction, then metrics like customer churn rate, Net Promoter Score (NPS), and customer feedback scores are highly relevant. If your focus is on operational efficiency, then metrics like cycle times, production output per employee, and defect rates become critical.

- Data Availability and Reliability: The metrics you select must be measurable and have reliable data sources. Ensure the data is accurate, consistent, and readily available to allow for meaningful comparisons.

- Industry Benchmarks: Look for established industry benchmarks to provide a meaningful context for your performance. Utilize publicly available data or industry reports to gauge your organization’s performance relative to your peers.

Examples of Benchmarkable Metrics

Benchmarking can encompass a wide range of metrics across various aspects of an organization. Some common examples include:

- Customer Satisfaction: Metrics like Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), and customer churn rate are crucial for evaluating customer loyalty and satisfaction.

- Employee Turnover: Employee turnover rates, employee satisfaction scores, and employee engagement scores are essential for understanding employee retention and morale.

- Financial Performance: Metrics like profitability, revenue growth, return on investment (ROI), and operating expenses are key for evaluating financial health.

- Operational Efficiency: Cycle times, production output, defect rates, and resource utilization are important indicators of operational effectiveness.

Comparing and Contrasting Different Metrics

Comparing metrics involves analyzing their values and trends to understand the relationships between them. For example, a high customer satisfaction score (CSAT) combined with a low employee turnover rate could suggest a positive work environment contributing to customer loyalty. Conversely, a high employee turnover rate alongside declining profitability could indicate issues that require investigation.

Table of Benchmarkable Metrics Across Industries

This table provides a concise overview of metrics that can be benchmarked across different industries.

| Industry | Financial Metrics | Customer Metrics | Employee Metrics |

|---|---|---|---|

| Retail | Gross Profit Margin, Sales per Square Foot | Customer Lifetime Value, Average Order Value | Employee Turnover Rate, Employee Training Hours |

| Technology | Revenue Growth, Profit Margin | Customer Churn Rate, Customer Acquisition Cost | Employee Satisfaction Score, Employee Engagement |

| Healthcare | Revenue per Patient, Profit Margin | Patient Satisfaction Score, Patient Readmission Rate | Staff Turnover Rate, Physician Satisfaction |

Addressing Challenges in Benchmarking

Benchmarking, while a powerful tool for improvement, often encounters obstacles. Understanding these challenges and developing strategies to overcome them is crucial for successful implementation. This section delves into common pitfalls and actionable solutions, emphasizing the importance of context-specific approaches to benchmarking.

Common Challenges in Benchmarking

Effective benchmarking hinges on accurate data collection and analysis. However, several obstacles can hinder the process. These include difficulties in identifying appropriate benchmarks, ensuring data comparability, and managing the complexity of the process. Furthermore, organizations often face resistance to change when implementing benchmarking results.

Identifying Appropriate Benchmarks

Selecting relevant benchmarks is paramount. A critical step involves defining the specific performance metrics to be compared. A clear understanding of the organization’s goals and objectives is vital to determine which benchmarks are most applicable. Choosing benchmarks that align with the organization’s strategy and resources is essential. For example, a small startup might not be able to benchmark against a large multinational corporation in terms of marketing expenditure, as the scale of operations differs significantly.

Ensuring Data Comparability

Data discrepancies between organizations often arise due to differing methodologies, reporting standards, and definitions of key performance indicators (KPIs). It is crucial to ensure that the data used for benchmarking is consistent and comparable. This involves standardizing data collection procedures and using consistent metrics. For instance, if comparing customer satisfaction scores, ensure all organizations are using the same survey instrument and scoring system.

Managing the Complexity of Benchmarking

Benchmarking projects can be complex, requiring significant resources, time, and effort. A detailed project plan with clearly defined goals, timelines, and responsibilities is essential to manage expectations and maintain focus. Effective communication and collaboration among stakeholders are key to successfully navigating the intricacies of the benchmarking process.

Overcoming Resistance to Change

Resistance to change is a common challenge. Implementing benchmarking results often requires adjustments to existing processes and practices. To overcome resistance, organizations should involve employees in the benchmarking process from the start, emphasizing the benefits of improvement and the potential for growth. This participatory approach helps foster buy-in and commitment.

Strategies to Mitigate Risks

Several strategies can help mitigate the risks associated with benchmarking. These include clearly defining the scope of the benchmarking exercise, ensuring data accuracy, and establishing clear communication channels. Additionally, having a well-defined feedback mechanism and ongoing support system can facilitate successful implementation.

Context-Specific Considerations

Benchmarking must be approached with a strong understanding of the unique context of each organization. Factors such as industry, size, location, and resources can significantly impact the appropriateness of chosen benchmarks. Ignoring context can lead to misleading comparisons and ineffective implementation. For instance, a local grocery store’s customer service metrics might be compared to other local grocery stores, not to a large-scale supermarket chain.

Possible Challenges and Solutions

| Challenge | Potential Solution |

|---|---|

| Inconsistent data definitions | Standardize data collection methods and definitions of KPIs. |

| Lack of resources | Prioritize and focus on key areas for benchmarking. |

| Data security concerns | Implement robust data security measures and adhere to privacy regulations. |

| Time constraints | Develop a phased approach to benchmarking, prioritizing key metrics. |

| Resistance to change | Involve employees in the benchmarking process and clearly communicate the benefits. |

Conclusion

In conclusion, benchmark reports are invaluable tools for organizations seeking to improve their performance and gain a competitive edge. Understanding the different types, components, and data analysis methods is crucial. By following best practices and considering the specific context of your organization, you can leverage these reports to drive strategic decision-making. This comprehensive guide provides a solid foundation for anyone looking to understand and utilize benchmark reports effectively.