Should You Use Apple Pay, Visa Tokens, Android Pay, or Bitcoin?

Should you use apple pay visa tokens android pay or bitcoin – Should you use Apple Pay, Visa Tokens, Android Pay, or Bitcoin? This question is more complex than it seems, as each payment method offers a unique blend of advantages and disadvantages. From the speed of transactions to security protocols and fees, understanding the nuances of each is crucial for making the right choice. This comprehensive guide dives deep into the pros and cons of each, comparing their strengths and weaknesses in various use cases, so you can confidently decide which payment method best suits your needs.

We’ll examine the security features of each, compare transaction speeds, and delve into the unique aspects of Bitcoin, including its transaction fees and technical details. We’ll also explore the concept of Visa Tokens, their interoperability benefits, and step-by-step setup procedures. Furthermore, we’ll analyze the strengths and weaknesses of mobile payment solutions like Apple Pay and Android Pay, considering their compatibility and ease of use.

Finally, we’ll look at transaction costs, potential hidden fees, and security and privacy considerations, providing a well-rounded perspective on each option.

Comparing Payment Methods

Choosing the right payment method is crucial for a seamless and secure online experience. Factors like security, transaction speed, and user-friendliness play a significant role in the decision-making process. This comparison delves into Apple Pay, Visa Tokens, Android Pay, and Bitcoin, exploring their strengths and weaknesses.Different payment methods cater to varying needs and preferences. Apple Pay, for instance, is popular for its ease of use and integration with Apple devices, while Bitcoin offers a decentralized alternative to traditional financial systems.

Deciding between Apple Pay, Visa tokens, Android Pay, or Bitcoin for payments can feel overwhelming. While those payment methods are definitely important, it’s also crucial to understand how structured data in articles impacts search engine optimization. For example, learning about structured data, like in this insightful piece on breaking news what is article structured data and how to test it , can help you optimize your content for better visibility.

Ultimately, choosing the right payment method still depends on individual needs and preferences, and not just on the technical side of structured data.

Understanding the nuances of each method empowers users to make informed choices that align with their individual requirements.

Security Features of Each Payment Method

Security is paramount when handling financial transactions. Each method employs unique security measures to protect user data and prevent fraud.

- Apple Pay utilizes tokenization, replacing sensitive card details with unique identifiers. This process significantly enhances security by limiting the exposure of actual card numbers. Biometric authentication, such as Touch ID or Face ID, further strengthens security, demanding a physical presence for authorized transactions.

- Visa Tokens are another tokenization method. They replace sensitive credit card information with unique, encrypted tokens, thereby safeguarding financial data during online transactions. This reduces the risk of unauthorized access to card information. These tokens are specific to Visa and are not applicable to other payment systems.

- Android Pay, similar to Apple Pay, employs tokenization to protect card details. It uses the same core principles for security, protecting sensitive data by replacing credit card numbers with unique tokens. Security is further reinforced by two-factor authentication in some instances.

- Bitcoin transactions, being decentralized, are cryptographically secure. Each transaction is recorded on a public ledger, the blockchain, which is virtually impossible to tamper with. However, the security of Bitcoin transactions relies heavily on the user’s private key management, and loss of this key can lead to permanent loss of funds. Security measures for Bitcoin primarily rely on the user’s diligence and understanding of cryptographic security protocols.

Pros and Cons of Each Method from a User Perspective

Evaluating the pros and cons from a user perspective is essential to choosing the most suitable method.

- Apple Pay: Pros include seamless integration with Apple devices, easy setup, and robust security measures. Cons might include the limitation to Apple ecosystem and reliance on device functionality. For example, users may face challenges if they don’t have an Apple device or prefer a broader range of payment options.

- Visa Tokens: Pros are enhanced security, allowing for easier integration into various platforms, improving security for merchants. Cons are that they are specific to Visa and may not be accepted everywhere that Apple Pay or other tokens are.

- Android Pay: Pros are similar to Apple Pay in terms of security and ease of use, but integrated into the Android ecosystem. Cons include a somewhat limited adoption rate compared to Apple Pay in some regions. For example, the number of merchants accepting Android Pay might be fewer than those accepting Apple Pay.

- Bitcoin: Pros include the potential for lower transaction fees and greater financial freedom. Cons are the volatility of Bitcoin’s value and the need for a deeper understanding of cryptocurrency technology to ensure secure transactions. Users need to be well-versed in the technical aspects of managing their Bitcoin wallets.

Transaction Speeds and Processing Times

Transaction speed is an important consideration for many users.

- Apple Pay, Visa Tokens, and Android Pay generally have very fast transaction speeds, often instantaneous. This is because they rely on existing payment infrastructure.

- Bitcoin transactions, due to their decentralized nature, can take a few minutes to a few hours to complete, depending on network congestion.

Comparison Table

| Payment Method | Security | Speed | Ease of Use | Fees |

|---|---|---|---|---|

| Apple Pay | High (tokenization, biometric authentication) | Very Fast | High (seamless integration) | Usually low, or none |

| Visa Tokens | High (tokenization) | Very Fast | Moderate (requires integration) | Usually low, or none |

| Android Pay | High (tokenization) | Very Fast | High (integration with Android) | Usually low, or none |

| Bitcoin | High (cryptographic security) | Variable (minutes to hours) | Moderate (requires understanding) | Potentially low, or high (transaction fees vary) |

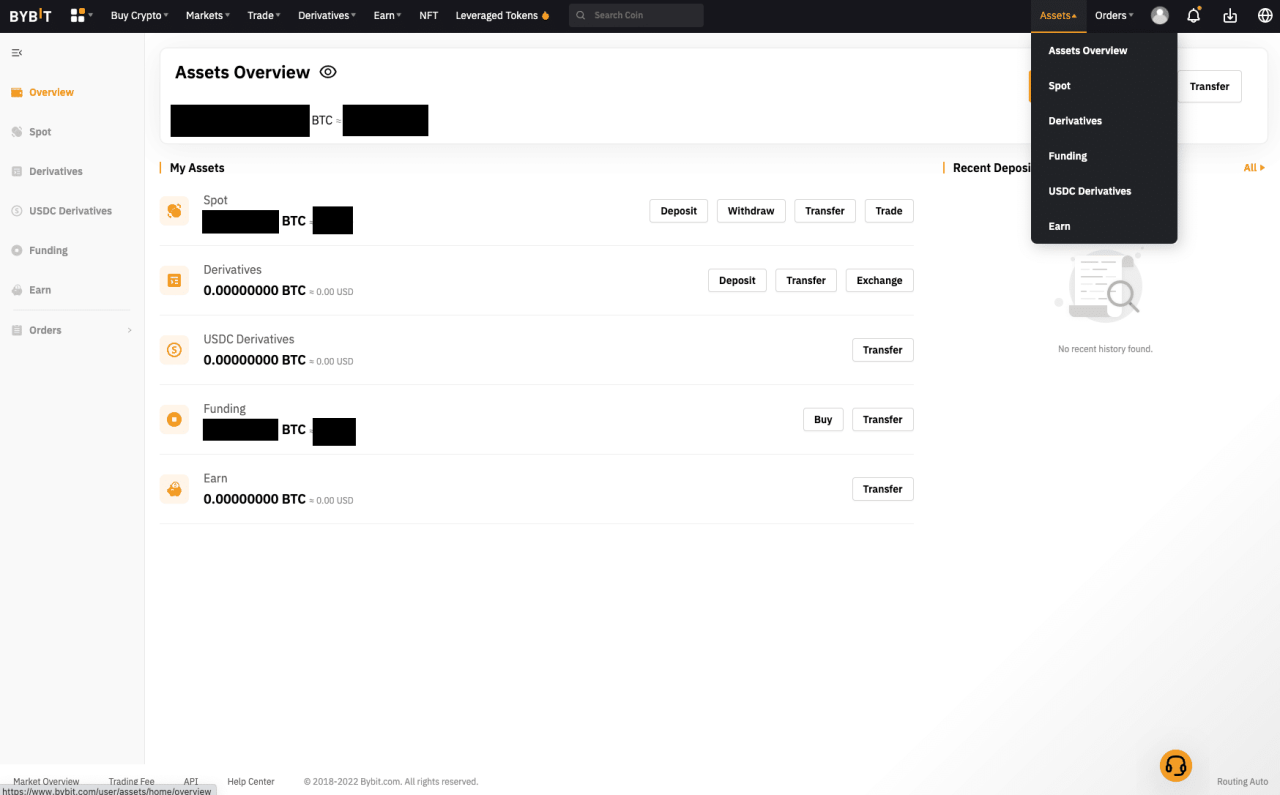

Bitcoin as a Payment Option

Bitcoin, a decentralized digital currency, offers a unique approach to payments. Unlike traditional methods tied to banks and credit systems, Bitcoin transactions occur directly between users on a public ledger. This characteristic has attracted both enthusiastic supporters and cautious observers. Its potential to disrupt existing financial systems is undeniable, but its volatility and technical complexities must also be acknowledged.Bitcoin’s decentralized nature eliminates the need for intermediaries like banks, potentially lowering transaction fees and increasing accessibility in regions with limited banking infrastructure.

Choosing between Apple Pay, Visa Tokens, Android Pay, or Bitcoin for digital transactions can be tricky. Understanding the nuances of each payment method is crucial. For example, learning how to optimize your website for search engines is key, and a recent SEO webinar, like the one hosted by JarDigital, seo webinar , can provide valuable insights.

Ultimately, the best payment method depends on individual needs and priorities, and you’ll need to consider factors like security, convenience, and transaction fees to make the right decision.

However, this same decentralization can lead to security concerns and difficulties in dispute resolution. The lack of central control also contributes to the inherent volatility of Bitcoin’s value, making it unsuitable for all payment situations.

Unique Characteristics of Bitcoin

Bitcoin transactions are verified and recorded on a public, distributed ledger called the blockchain. This transparency is a key feature, though it also exposes transaction details to the public. Bitcoin’s cryptography ensures secure and tamper-proof transactions, while its limited supply (21 million coins) contributes to its perceived value and potential as a store of value. Its pseudonymous nature allows for transactions without revealing the identities of the sender and receiver.

Potential Benefits of Using Bitcoin

Bitcoin offers the potential for lower transaction fees compared to traditional payment methods, especially for international transfers. This reduced cost is attractive to businesses and individuals operating globally. The decentralized nature of Bitcoin can increase financial inclusion, offering access to financial services in regions with limited or no banking infrastructure.

Potential Drawbacks of Using Bitcoin

The volatility of Bitcoin’s value poses a significant risk to users. Investment in Bitcoin carries a high degree of uncertainty, making it unsuitable for everyday transactions where price stability is crucial. The complexity of Bitcoin transactions and the need for secure wallets can pose a barrier to adoption by the general public. Scams and fraudulent activities related to Bitcoin are also a concern for users.

Deciding between Apple Pay, Visa tokens, Android Pay, or Bitcoin can be tricky. Ultimately, the best choice depends on your individual needs and spending habits. Examining Amazon’s brand performance, like analyzing amazon brand metrics , provides insight into how different payment methods might affect your purchasing experience. So, while Amazon’s strategies are intriguing, the key question remains: which payment method aligns best with your own financial goals?

Technical Aspects of Bitcoin Payments

Bitcoin transactions are initiated by creating a digital signature. This process uses cryptography to ensure the authenticity and integrity of the transaction. The transaction is then broadcast to the Bitcoin network, where miners validate and add it to the blockchain. The blockchain’s immutability guarantees the permanence of the transaction record.

Bitcoin Wallets and Platforms

Numerous wallets and platforms facilitate Bitcoin transactions. Desktop wallets provide offline storage of private keys, while mobile wallets offer greater convenience. Exchanges like Coinbase and Kraken allow users to buy, sell, and hold Bitcoin. Bitcoin payment processors enable businesses to accept Bitcoin as payment. Choosing the appropriate wallet or platform depends on individual needs and risk tolerance.

Transaction Fees Comparison

| Payment Method | Typical Transaction Fee | Notes |

|---|---|---|

| Apple Pay/Visa Tokens | Usually negligible | Dependent on network and merchant |

| Android Pay | Usually negligible | Dependent on network and merchant |

| Bitcoin | Variable, can be low or high | Dependent on network congestion and transaction size |

Transaction fees for Bitcoin can fluctuate significantly based on network congestion. During periods of high demand, fees can increase substantially.

Visa Tokens and Payment Interoperability

Visa tokens are a crucial component of modern payment systems, enhancing security and interoperability across various platforms. They represent a unique approach to handling sensitive payment information, acting as a substitute for the actual card details. This allows for a more secure and streamlined transaction process, especially in online environments. By abstracting away the complexities of individual card numbers, Visa tokens simplify the flow of payments while maintaining the highest level of security.Visa tokens operate by creating a unique, encrypted identifier for a credit or debit card.

This identifier is used in transactions instead of the actual card number. This process significantly reduces the risk of fraud and unauthorized access to financial data. The tokenization process is handled securely by Visa and its network of partners, providing a robust layer of protection.

Visa Token Security Enhancement

Visa tokenization significantly enhances payment security by decoupling sensitive card information from the transaction itself. This separation protects against data breaches and unauthorized access. When a token is used, the original card number is never transmitted, making it nearly impossible for hackers to steal or misuse it. This crucial aspect of security is essential for safeguarding user financial information in an increasingly digital world.

Visa Token Interoperability Across Platforms

Visa tokens enable seamless interoperability between various payment platforms. This means that a cardholder can use their Visa token on different payment apps, websites, and in-store terminals without needing to re-enter their card details. This unified approach simplifies the payment process, allowing for a consistent experience across different channels. This feature is especially beneficial for online shoppers who can use the same payment method across numerous websites and apps.

Advantages of Visa Tokens

Visa tokens offer significant advantages for both online and in-store transactions. In online transactions, tokenization safeguards sensitive data from potential breaches, ensuring a more secure shopping experience. In-store, tokens streamline the checkout process, providing a faster and more efficient transaction. The ease of use and security are critical aspects that enhance the user experience.

Setting Up Visa Tokens

The process for setting up Visa tokens varies slightly depending on the payment method used. However, the general procedure involves linking your credit or debit card to a payment app or service that supports Visa tokenization. The specific steps usually include verifying your identity and authorising the tokenization process. Once set up, the token is ready to be used in various transactions.

A user-friendly interface typically guides the setup process.

Visa Token Security Protocol Comparison

| Feature | Visa Tokens | Other Payment Methods (e.g., Card-on-File) |

|---|---|---|

| Card Number Transmission | Encrypted token is used; original card number is not transmitted. | Original card number is stored or transmitted. |

| Security in Case of Breach | Tokenized data is less vulnerable; the breach only impacts the token, not the original card. | Breach compromises the original card information. |

| Transaction Speed | Faster processing due to reduced data handling. | Potentially slower due to card number transmission. |

| Data Protection | Stronger data encryption protocols protect the token. | Data security varies; some methods lack robust encryption. |

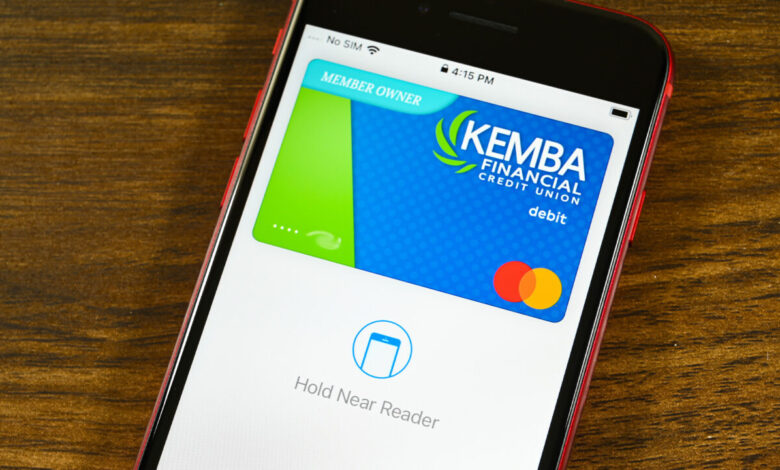

Apple Pay and Android Pay

Apple Pay and Android Pay are two prominent mobile payment systems that have significantly impacted the way consumers make purchases. These platforms leverage smartphone technology to streamline transactions, offering a convenient alternative to traditional methods. Their popularity stems from their ease of use and integration with various devices and services, though their compatibility and security protocols differ.These platforms offer users a secure and convenient way to pay for goods and services, but their strengths and weaknesses should be carefully evaluated to determine their suitability for individual needs.

Ease of Use and Integration

Apple Pay and Android Pay are designed for seamless integration with various devices and services. Both platforms are straightforward to set up and use. Users can add payment cards to their accounts and make purchases by simply tapping their phone or watch on a compatible payment terminal. This simplicity makes transactions quick and efficient, a key driver of their popularity.

The integration with various apps and services further enhances their usability, allowing users to pay directly within those apps without needing to switch to a separate payment platform.

Compatibility with Merchants and Businesses

The compatibility of Apple Pay and Android Pay with merchants and businesses is a crucial factor for users. While both platforms have gained significant traction, there are still variations in merchant acceptance. Apple Pay generally has broader acceptance among major retailers, while Android Pay’s acceptance may vary depending on the region and specific merchant. Users should check if their preferred stores support either platform before relying on them.

Security Protocols

Both Apple Pay and Android Pay employ robust security protocols to protect user data. These systems utilize tokenization, a process where the actual credit card number is replaced with a unique token during the payment process. This token is used for transactions and is never transmitted to the merchant, providing an extra layer of security. Furthermore, both platforms implement encryption technologies to safeguard sensitive information during transmission.

The use of biometric authentication (fingerprint or facial recognition) adds an extra layer of security and prevents unauthorized access.

Comparison of Features and Functionalities

| Feature | Apple Pay | Android Pay |

|---|---|---|

| Payment Methods | Supports credit and debit cards, and some contactless payment methods. | Supports credit and debit cards, contactless payments, and potentially other payment methods based on the user’s bank integration. |

| Device Compatibility | Works with iPhones and Apple Watches. | Works with Android phones and potentially other devices via integration with Google Wallet. |

| Merchant Acceptance | Generally higher acceptance rate among major retailers. | Acceptance rate varies by region and merchant. |

| Security | Utilizes tokenization, encryption, and biometric authentication. | Utilizes tokenization, encryption, and biometric authentication (where available). |

| Other Features | Integration with Apple Wallet and other Apple services. | Integration with Google Wallet and other Google services. |

Use Cases and Scenarios: Should You Use Apple Pay Visa Tokens Android Pay Or Bitcoin

Choosing the right payment method hinges on the specific context. Factors like transaction amount, security concerns, desired speed, and the merchant’s acceptance play crucial roles. This section delves into various scenarios where each payment method shines.

Everyday Purchases

Everyday purchases, from grabbing coffee to buying groceries, are ideal for contactless payment methods. The convenience and speed of Apple Pay and Android Pay make them superior choices. Their seamless integration with smartphones and the reduced need for physical cards streamline the transaction process. For example, paying for a latte at a local café is significantly faster and more convenient with Apple Pay or Android Pay than using a traditional debit or credit card.

Large Purchases and Transactions

For large purchases, like a new appliance or a car, the security and trust associated with traditional payment methods like Visa tokens, backed by a bank, might be preferred. While digital payment methods are increasingly popular, the established infrastructure and regulatory framework around traditional cards provide a certain level of confidence for substantial financial commitments. Using a credit card, with its associated rewards programs, might also be beneficial in this context.

International Transactions

International transactions often involve currency conversion and potential transaction fees. Visa tokens, with their global acceptance, can streamline international payments, reducing the hassle of managing different currencies and exchange rates. Using a credit card or debit card, with potential additional fees, might be less optimal. Bitcoin, while theoretically capable of international transactions, may face significant transaction fees and currency volatility.

High-Value Transactions with Increased Security

High-value transactions, such as online purchases of expensive electronics or high-end goods, warrant increased security. In these cases, using Visa tokens, which often offer enhanced security protocols, might be a preferred option. The tokens provide a layer of security by masking sensitive card information, while still enabling seamless transactions. Bitcoin, despite its increasing use in high-value transactions, still faces challenges in terms of security and regulatory compliance.

Transactions with Limited Merchant Acceptance

The acceptance of each payment method varies across merchants. Some merchants may not accept Bitcoin or may not support contactless payment methods. It is crucial to verify a merchant’s payment options before proceeding with a transaction. For example, some smaller businesses may not accept Apple Pay or Android Pay. In these situations, traditional methods like Visa tokens are more reliable.

Use Cases for Payment Tokens

Payment tokens offer a unique benefit in situations where you want to decouple your actual card from the transaction. This enhanced security and convenience can be crucial for online purchases or when you want to control the amount of spending or limit liability. For instance, when shopping online, creating a token for a specific amount allows you to limit the risk of unauthorized charges.

Using a payment token in such scenarios is demonstrably more secure than using your actual credit card details directly.

Optimal Use Cases for Each Payment Method

| Payment Method | Optimal Use Cases |

|---|---|

| Apple Pay/Android Pay | Everyday purchases, quick transactions, contactless payments, enhanced security (when used with appropriate security measures). |

| Visa Tokens | International transactions, high-value transactions, increased security (masking card details), online purchases. |

| Bitcoin | High-value transactions, peer-to-peer payments, international transactions (with caveats), when seeking anonymity (with caveats). |

| Traditional Cards | Large purchases, transactions with limited merchant acceptance, situations requiring rewards programs. |

Transaction Costs and Fees

Understanding the financial implications of each payment method is crucial for informed decision-making. Transaction fees, whether explicit or hidden, can significantly impact the overall cost of a purchase or transfer. This section delves into the various transaction fees associated with Apple Pay, Android Pay, Visa tokens, and Bitcoin, providing insights into potential long-term financial implications.

Transaction Fees for Apple Pay and Android Pay

Apple Pay and Android Pay generally operate with minimal transaction fees, primarily for in-store purchases. These services are designed to streamline payment processes, and associated costs are often absorbed by the merchant or credit card network. However, some incidental costs might arise from the use of a bank card linked to these platforms. This might include interchange fees, which are typically a small percentage of the transaction amount.

These are usually passed on to consumers, indirectly.

Transaction Fees for Visa Tokens

Visa tokens are essentially digital representations of existing credit or debit cards. They operate similarly to Apple Pay and Android Pay, but with a focus on security and tokenization. The fees associated with Visa tokens are largely dependent on the underlying card. The token itself doesn’t usually incur additional fees. However, the card issuer’s fees and potentially any service charges associated with your specific card could be relevant.

Transaction Fees for Bitcoin

Bitcoin transactions, due to their decentralized nature, have transaction fees that vary significantly. These fees, often expressed in Bitcoin, are designed to incentivize network participants and process transactions. Bitcoin miners, who validate transactions, receive these fees. Transaction fees can fluctuate greatly based on network congestion. High network congestion may lead to higher transaction fees.

These fees are explicit and are typically visible to the user before confirming a transaction.

Comparison of Transaction Costs Across Transaction Types

The following table provides a simplified overview of transaction costs across different payment methods and transaction types. Note that these costs are subject to change based on market conditions, card issuer policies, and network congestion.

| Payment Method | Online Purchase (USD 100) | In-Store Purchase (USD 50) | International Transfer (USD 500) |

|---|---|---|---|

| Apple Pay/Android Pay | Typically minimal, potentially negligible. | Typically minimal, potentially negligible. | Dependent on bank/card, potentially higher than domestic. |

| Visa Tokens | Typically minimal, potentially negligible. | Typically minimal, potentially negligible. | Dependent on bank/card, potentially higher than domestic. |

| Bitcoin | Variable, depends on network congestion. | Variable, depends on network congestion. | Variable, depends on network congestion. |

Hidden Costs and Long-Term Implications

While some payment methods appear to have low transaction fees, hidden costs can accumulate over time. For example, international transactions using Apple Pay or Visa tokens might incur higher fees from the card network or bank, and potentially exchange rate fluctuations. Bitcoin’s volatility can also lead to unexpected costs if the value of Bitcoin drops between the time of sending and receiving funds.

Long-term financial implications are dependent on individual spending habits and the frequency of transactions.

Security and Privacy Considerations

Protecting your financial data is paramount when choosing a payment method. Each option employs different security protocols, and understanding these protocols is crucial for informed decision-making. This section delves into the security measures, risks, and user-centric strategies for each payment method, providing a comprehensive overview.

Security Measures Employed by Each Payment Method

Different payment systems employ various security measures to safeguard user data. Apple Pay, for instance, utilizes advanced encryption techniques and tokenization to protect sensitive information. Android Pay employs similar methods, focusing on secure storage and transaction processing. Visa tokens provide a layer of protection by replacing sensitive card details with unique identifiers. Bitcoin transactions, while decentralized, rely on cryptographic hashing and digital signatures for security.

Understanding these methods is essential for evaluating their respective strengths and weaknesses.

Risks and Vulnerabilities Associated with Each Payment Method

Each payment method presents specific security risks. Phishing attacks, for example, can target users of any platform. Compromised payment systems or data breaches are another concern, though the frequency and severity can vary significantly. Furthermore, the reliance on third-party infrastructure for payment processing introduces an element of risk that users need to be aware of. For Bitcoin, the volatility of the market and the possibility of scams or illicit activities are significant vulnerabilities.

Understanding these risks allows users to make informed choices.

Steps Users Can Take to Improve Security

Users can take proactive steps to enhance the security of their payment transactions. Strong passwords, multi-factor authentication, and regular software updates are crucial for protecting accounts across all platforms. Furthermore, vigilance against phishing attempts and suspicious links is essential. Avoiding public Wi-Fi networks for sensitive transactions and monitoring account activity are additional protective measures. These precautions are vital to mitigate risks and safeguard financial data.

Handling Data Breaches and Security Incidents

Each payment provider has a process for handling data breaches. This often involves notifications to affected users, credit monitoring services, and steps to limit potential financial harm. The specific protocols and procedures vary by provider and may depend on the scale and nature of the incident. For example, Visa has established a robust system for handling fraud and security breaches.

Apple Pay has mechanisms to detect and respond to fraudulent activity. Knowing how each provider responds to security incidents is a key element in assessing risk.

Summary of Security Measures and Risks

| Payment Method | Security Measures | Risks |

|---|---|---|

| Apple Pay | Tokenization, encryption, strong authentication protocols | Potential for app vulnerabilities, data breaches targeting payment processors |

| Android Pay | Tokenization, encryption, secure storage | Vulnerabilities in Android operating system, data breaches affecting payment processors |

| Visa Tokens | Tokenization, secure transmission of tokens | Risks associated with token storage and handling, potential breaches in token management systems |

| Bitcoin | Cryptographic hashing, digital signatures, decentralized network | Volatility of the market, scams, risks associated with peer-to-peer transactions, regulatory uncertainties |

Future Trends and Innovations

The landscape of mobile and cryptocurrency payments is constantly evolving. Emerging technologies are reshaping how we transact, offering greater convenience, security, and potentially, lower costs. This section explores some of the key future trends and innovations impacting the payment ecosystem.The rapid advancement of technology is pushing the boundaries of what’s possible in mobile and cryptocurrency payments. From decentralized platforms to enhanced security measures, these innovations are poised to revolutionize the way we interact with financial systems.

Decentralized Payment Systems

The rise of decentralized payment systems, powered by blockchain technology, is a significant trend. These systems offer the potential for faster, cheaper, and more transparent transactions. Examples include stablecoins and decentralized exchanges, which are increasingly used for peer-to-peer payments. The potential for lower transaction fees and greater security compared to traditional systems is attracting significant interest.

Enhanced Security and Privacy

Future payment systems will likely prioritize enhanced security and privacy. Biometric authentication, such as facial recognition and fingerprint scanning, will likely become more integrated into mobile payment platforms. Furthermore, advanced encryption techniques and zero-knowledge proofs will protect sensitive transaction data, ensuring greater confidentiality. These developments are critical for building trust and encouraging wider adoption.

The Impact of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are increasingly influencing payment systems. AI-powered fraud detection systems can analyze vast amounts of transaction data to identify and prevent fraudulent activities in real-time. ML algorithms can personalize payment experiences, suggesting optimal payment options based on individual spending habits and preferences. This will enhance efficiency and tailor the payment process to the user.

Integration with IoT Devices

The Internet of Things (IoT) is another area poised to significantly impact payment methods. Imagine paying for goods and services through smart home devices or wearables. This seamless integration of payment functionality into various everyday objects will lead to a more intuitive and convenient payment experience. The potential for a truly hands-free payment system is compelling.

Evolution of Payment Methods (Next 5 Years), Should you use apple pay visa tokens android pay or bitcoin

| Year | Emerging Trend | Impact on Payment Methods | Example |

|---|---|---|---|

| 2024 | Increased adoption of decentralized payment systems | Faster, cheaper, and more transparent transactions become more commonplace. | Growing use of stablecoins for peer-to-peer transactions. |

| 2025 | Enhanced security measures in mobile payments | Greater user confidence in mobile payment platforms. | Widespread use of biometrics for authentication. |

| 2026 | AI-powered fraud detection | Reduction in fraudulent activities and increased security for consumers. | Real-time detection and prevention of fraudulent transactions. |

| 2027 | Integration with IoT devices | More convenient and seamless payment experiences. | Paying for groceries using a smart refrigerator. |

| 2028 | Personalized payment experiences | Tailored payment options based on user behavior. | Smart recommendations for optimal payment methods based on spending patterns. |

Last Word

Ultimately, the best payment method depends on your individual needs and priorities. Weighing the security, speed, ease of use, and costs associated with each option is essential. This guide provided a thorough comparison, highlighting the key factors to consider when making your decision. Whether you’re a frequent online shopper, a mobile-first user, or a crypto enthusiast, this analysis should empower you to choose the payment method that aligns perfectly with your financial and technological preferences.

So, should you use Apple Pay, Visa Tokens, Android Pay, or Bitcoin? The answer lies within this comprehensive analysis.