TikTok Shadow Ban What It Is, How It Happens

TikTok shadow ban what it is how it happens is a crucial topic for anyone trying to build a presence on the platform. It’s a subtle, often unnoticed, way TikTok limits the visibility of your content, potentially hindering your reach and growth. This in-depth look explores what a shadow ban is, how it affects your content, and what you can do to avoid it.

Understanding the different types of content that can trigger a shadow ban, such as spam, low-quality videos, or content violating community guidelines, is essential. Knowing the signs to look for and the steps to take to regain visibility will help you navigate this aspect of the TikTok ecosystem effectively.

Defining TikTok Shadow Ban

TikTok’s shadow ban is a tricky issue, often manifesting as a subtle reduction in content visibility rather than a clear account suspension. It’s a common concern for creators, and understanding its characteristics is crucial for effective troubleshooting.A TikTok shadow ban essentially hides your content from the algorithm’s recommendation system. This means your videos might not appear in relevant feeds or searches, and even if someone finds your profile, your posts might not be as prominently displayed as they used to be.

It’s like your content is “invisible” to the platform’s recommendation engine.

TikTok shadow bans can be tricky to spot, essentially hiding your content from the algorithm. This can impact your reach significantly, but luckily, savvy online course providers can boost their visibility with the right tools. For example, the ultimate smm providers for online course providers offer strategies to get your content in front of the right eyes.

Understanding the ins and outs of these hidden bans is key to ensuring your content isn’t being buried, so be sure to research how these bans work to avoid getting caught.

Key Characteristics of a Shadow Ban

A shadow ban is distinct from other account restrictions on TikTok because it’s less obvious. Unlike a temporary or permanent suspension, which often comes with explicit warnings, a shadow ban doesn’t typically result in a notification. Users might only notice a gradual decrease in views, likes, comments, and shares over time. This gradual decline is a critical signifier.

Suspecting a Shadow Ban

There are several indicators that might suggest a shadow ban is impacting your TikTok account. These are often subtle and require careful observation.

- Decreased Reach: A noticeable drop in the number of views, likes, and shares on your videos. This is often a primary indicator, as content that is engaging but not reaching the intended audience is a strong sign of a potential issue.

- Reduced Algorithm Visibility: Your videos might appear less frequently in relevant search results or recommendations. This means your content is not being showcased as actively as it used to be.

- Unresponsive Engagement: While you might see an increase in views, likes, or comments, the engagement is not sustainable, and the growth doesn’t reflect the actual interest.

- Inconsistency in Performance: The performance of your content might be inconsistent, with some videos performing well while others don’t get any traction. This can be a sign that something is hindering the visibility of your content.

Comparison with Other TikTok Account Issues

Understanding the differences between a shadow ban and other account issues is crucial for effective troubleshooting. The following table contrasts shadow bans with common account restrictions.

| Feature | Shadow Ban | Other Account Issues |

|---|---|---|

| Visibility | Reduced visibility of content; content is not appearing in relevant feeds or searches. | Direct restrictions, suspensions, or limitations on posting, commenting, or interacting. |

| Noticeability | Often subtle; gradual decrease in engagement metrics. | Often clear notifications, warnings, or specific limitations. |

| Impact | Reduced reach and engagement; your content is less likely to be seen by the intended audience. | Specific restrictions on content or account, like limited views, comments, or shares. |

Causes of TikTok Shadow Bans

TikTok’s shadow ban is a frustrating experience for creators. It’s a hidden penalty that reduces your content’s visibility without a clear explanation. Understanding the reasons behind it can help you avoid future issues and maintain a healthy presence on the platform.TikTok employs sophisticated algorithms to curate the content its users see. These algorithms are constantly evolving, and while they aim to deliver relevant and engaging content, they can sometimes misinterpret creators’ intentions or content characteristics, leading to a shadow ban.

Common Reasons for Shadow Bans

Several factors can trigger a shadow ban on TikTok. These range from simple mistakes in content creation to more complex issues involving platform guidelines. Understanding these factors can help you create content that adheres to TikTok’s expectations and minimizes the risk of a shadow ban.

Content-Related Causes of Shadow Bans

TikTok’s algorithm is highly sensitive to certain types of content. Inconsistent or inappropriate content often results in a shadow ban.

Ever wondered why your TikTok videos aren’t getting the views they deserve? A TikTok shadow ban might be the culprit. It’s essentially when your content is hidden from the algorithm, making it harder for others to find. Understanding how it happens is key to getting your content in front of more people. Luckily, learning about social media marketing tools can give you a major edge in this game! For example, knowing how to use analytics in social media marketing tools can reveal patterns in your content performance, potentially pointing to why your content isn’t reaching its full potential.

Armed with this knowledge, you can adjust your strategy and hopefully beat the shadow ban! social media marketing tools a beginners guide will provide further insight into these crucial tools.

| Content Type | Description | Example |

|---|---|---|

| Spam | Repeated posting of irrelevant content, or content unrelated to the account’s niche or engagement strategy. | Constantly posting videos about unrelated topics, or excessively using trending sounds or hashtags without a clear connection to the account’s content. |

| Low-quality | Content that doesn’t meet TikTok’s standards for visual and audio quality, or lacks engagement potential. | Videos with low resolution, poor audio, or repetitive content. Videos that are too short, too long, or lack a clear theme can also fall into this category. |

| Infringement | Content that violates TikTok’s community guidelines, such as copyright infringement, harassment, or the promotion of harmful or illegal activities. | Using copyrighted music or video clips without proper licensing, or posting content that promotes violence, discrimination, or hate speech. |

TikTok’s community guidelines are designed to maintain a safe and positive environment for all users. Adherence to these guidelines is crucial for avoiding a shadow ban.

Other Potential Causes

Beyond content quality, several other factors can lead to a shadow ban. Maintaining a consistent posting schedule, engaging with other creators, and participating in trending challenges can help improve your account’s visibility.

Effects of a TikTok Shadow Ban: Tiktok Shadow Ban What It Is How It Happens

A TikTok shadow ban, while invisible to the user, can have a significant and detrimental impact on their account’s performance. This invisible barrier severely limits the visibility of your content, impacting engagement and overall growth on the platform. Understanding the effects is crucial for mitigating the damage and regaining your online presence.A shadow ban essentially hides your content from the TikTok algorithm’s recommendation system.

This means your videos are no longer surfaced to users who might be interested in the content. This lack of visibility leads to decreased engagement and a halt in account growth, making it challenging to build a following and achieve the desired results.

Content Reach Reduction

The core effect of a shadow ban is a drastic reduction in content reach. Your videos, even if well-produced and engaging, might not be seen by as many users as they would normally be. This is because the algorithm, now working against you, isn’t recommending your content to new viewers. Consequently, potential viewers are not discovering your work.

The result is a significantly reduced number of views and a smaller audience.

Decreased Engagement

A shadow ban often leads to a substantial drop in engagement metrics. This decline encompasses likes, comments, and shares, as your content is not reaching the intended audience. Fewer people seeing your content directly translates to less interaction with it. This stagnation in engagement can create a negative feedback loop, further diminishing the algorithm’s likelihood of recommending your videos.

Stagnant Account Growth

The negative impact of a shadow ban on account growth is undeniable. When your content isn’t being seen, you aren’t gaining new followers. The lack of visibility and engagement makes it difficult to attract new users, leading to a standstill in follower acquisition. This stagnation can significantly hinder your efforts to build a successful TikTok presence.

Impact on User Experience

A shadow ban alters the user experience in several ways. Users may find their content less visible and discoverable, impacting the joy and fulfillment of sharing their creations. The algorithm’s diminished recommendations can lead to frustration and discouragement, potentially deterring further content creation. The reduction in engagement and visibility may affect a user’s overall satisfaction with the platform.

Summary of Effects

| Aspect | Effect | Description |

|---|---|---|

| Content Reach | Reduced | Content may not be seen by as many users, leading to fewer views. |

| Engagement | Decreased | Fewer likes, comments, and shares, resulting in a diminished interaction rate. |

| Account Growth | Stagnant | Account may not gain followers or visibility, hindering the building of a strong presence. |

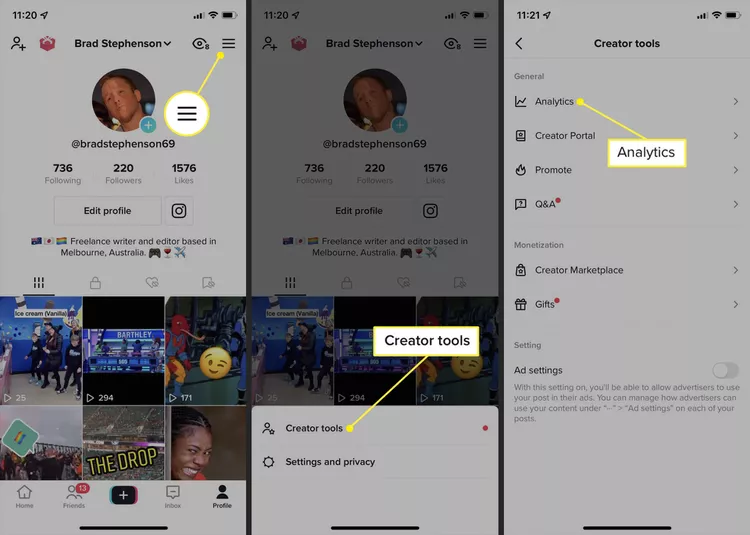

Detecting a TikTok Shadow Ban

Unveiling a TikTok shadow ban can feel like trying to catch a ghost. It’s a subtle form of penalty, making your content effectively invisible to a significant portion of your audience without a clear warning. The lack of obvious signs can make it frustrating to diagnose, but careful observation can often reveal the telltale indicators.Understanding the methods for detecting a shadow ban is crucial for regaining visibility and engagement on the platform.

Recognizing the subtle shifts in your content’s performance is key to pinpointing whether you’ve fallen victim to this invisible penalty.

Ever wondered why your TikTok videos aren’t getting the views they deserve? It might be a shadow ban! A shadow ban hides your content from the algorithm, making it harder for people to find you. One way to combat this, and increase your visibility on other platforms, is by scheduling your Instagram posts. This can help ensure you’re posting at optimal times for your audience, and can improve your overall engagement.

Learn how to schedule Instagram posts effectively here. Ultimately, understanding what causes a shadow ban is key to avoiding it and keeping your content visible on TikTok.

Signs of a TikTok Shadow Ban

Several subtle shifts in your TikTok account’s performance can indicate a shadow ban. These aren’t always definitive, but taken together, they can form a compelling case. Monitoring these indicators is essential to proactively address potential issues and regain traction.

- Decreased Reach and Engagement: A significant drop in the number of views, likes, comments, shares, or saves on your posts is a prominent red flag. If your usual engagement numbers plummet without a discernible change in your content quality or posting schedule, it’s worth investigating.

- Lowered Visibility in Search Results: If your videos are no longer appearing as prominently in search results, or you’re seeing fewer recommendations, this might suggest a shadow ban. This could be a result of your account or content violating platform policies.

- Reduced Impressions and Views from New Users: If you’re noticing a decline in impressions or views from users who are new to your account, this could be a signal. A lack of new eyes on your content can be a consequence of the shadow ban.

- Inconsistency in Performance Metrics: Unexpected and erratic fluctuations in your metrics, such as an abrupt dip in views followed by a surge and then another drop, can be indicative of a shadow ban. Consistency in engagement is typically a hallmark of an active, visible account.

- Decreased Video Discovery Rate: A reduced number of people discovering your videos through recommendations or trending challenges can be another clear sign. If your videos aren’t appearing in the discovery streams, it could indicate a shadow ban.

Examples of Content Appearance Under a Shadow Ban

The appearance of your content might differ under a shadow ban. The way your videos perform is often the first indication.

- Videos might be getting fewer views than usual. Videos that once were consistently well-viewed may suddenly show a significant decline in engagement metrics.

- Your videos may not appear in the ‘For You’ page as often. If your videos are no longer appearing in the algorithm’s recommendations, your visibility will decrease.

- Videos might not be recommended to users in your target audience. This suggests the algorithm is not recognizing your content as relevant to a significant portion of the platform’s users.

Possible Tell-Tale Signs of a Shadow Ban, Tiktok shadow ban what it is how it happens

Below is a list of potential signs that your TikTok account might be experiencing a shadow ban. Note that the presence of multiple indicators increases the likelihood of a shadow ban.

- Consistent decline in viewership and engagement across all or most videos.

- Lowered discoverability in searches and recommendations.

- Noticeable decrease in new followers and interactions from previously engaged users.

- A sudden drop in the reach of your posts, especially if your posting habits remain consistent.

- Inconsistency in the performance of similar content, which suggests a change in the algorithm’s response.

Strategies to Avoid a TikTok Shadow Ban

TikTok’s shadow ban can be a frustrating experience, making your hard work feel invisible. Understanding the reasons behind these mysterious disappearances is the first step toward preventing them. By proactively adhering to TikTok’s guidelines and optimizing your content strategy, you can significantly reduce the risk of being shadow-banned.

Best Practices for Content Creation

Effective content creation is paramount for maintaining a positive presence on TikTok. Quality content that resonates with the platform’s algorithm is more likely to be showcased to a wider audience.

- High-Quality Visuals and Audio: Invest in visually appealing and engaging content. High-quality videos with clear audio are more likely to captivate viewers and maintain their attention. This engagement is a strong signal to the algorithm that your content is worth promoting.

- Authenticity and Consistency: Be true to yourself. Authenticity fosters genuine connections with your audience. Maintaining a consistent posting schedule helps the algorithm understand your content’s pattern, which can be beneficial for its promotion.

- Relevance and Trending Topics: Staying current with relevant trends and hashtags can significantly increase your visibility. However, don’t just hop on every trend; focus on those that genuinely align with your content niche. Researching relevant trending topics and incorporating them into your content can help you reach a wider audience.

- Engagement with Comments and Direct Messages: Actively engage with comments and direct messages. Responding to your audience fosters a sense of community and shows the algorithm that your content is interactive. This interaction demonstrates that your content resonates with viewers.

Adherence to TikTok’s Community Guidelines

TikTok’s community guidelines are essential for maintaining a healthy and positive platform environment. Failure to adhere to these guidelines can lead to penalties, including shadow bans.

- Respectful Communication: Avoid hate speech, harassment, or any form of offensive language. Treat others with respect, and create a welcoming environment for your audience. Disrespectful or harmful content will negatively affect your visibility on the platform.

- Appropriate Content: Ensure your content aligns with TikTok’s guidelines regarding age appropriateness, privacy, and intellectual property. Be mindful of the types of content you create and share to avoid violations.

- Copyright Compliance: Avoid using copyrighted material without proper attribution. Copyright infringement can lead to account penalties, including shadow bans. Respect copyright laws and use content legally.

Flowchart for Avoiding a TikTok Shadow Ban

Note: This is a conceptual flowchart. A visual representation would need to be created using a flowcharting tool.

This flowchart visually Artikels the steps for maintaining a positive presence on TikTok and avoiding a shadow ban. It highlights the importance of creating high-quality content, adhering to community guidelines, and engaging with your audience.

Recovering from a TikTok Shadow Ban

Getting your TikTok account back to normal after a shadow ban can feel like climbing a mountain, but it’s not impossible. This isn’t a permanent ban, and while the path to recovery isn’t always clear-cut, consistent effort and a shift in strategy can help you regain visibility. Understanding the underlying reasons for the ban is crucial to developing a recovery plan.The recovery process often involves a combination of adjustments to your content creation and interaction methods.

It’s not a quick fix; expect a period of patience and perseverance as you work to re-establish your presence on the platform. The key is to demonstrate to TikTok’s algorithm that your content aligns with their community guidelines and user experience expectations.

Content Strategy Adjustments

A crucial aspect of recovery involves scrutinizing and refining your content strategy. Simply continuing with the same approach that led to the shadow ban won’t work. TikTok’s algorithm is sophisticated, and a change in your content creation habits is necessary to prove you’re now in compliance.

- Diversify Content Types: Don’t rely solely on one type of content. Experiment with different formats – reels, short-form videos, and potentially even longer-form videos. This demonstrates that you’re not just trying to pump out content but are genuinely interested in creating a varied experience for your audience.

- Focus on High-Quality Visuals: Invest in good lighting, sound, and editing. High-quality content is more engaging and more likely to retain viewers. Poorly produced videos may be perceived as low-effort, which can trigger a negative response from TikTok’s algorithm.

- Authenticity and Engagement: Maintain an authentic and engaging voice. Interact with your followers, respond to comments, and participate in trending topics. Genuine engagement fosters a positive connection with the algorithm.

Engagement and Community Building

Your interactions with other users and your community are vital for recovering from a shadow ban. This aspect goes beyond just posting content; it involves building relationships.

- Meaningful Interactions: Engage with other creators’ content and comments. Don’t just leave generic likes; try to add value to the conversation by asking thoughtful questions or offering relevant insights. This fosters a sense of community and shows TikTok that you’re a positive influence.

- Consistent Engagement: Engage with your audience regularly. Responding to comments and messages promptly shows that you value your followers and their input. This demonstrates a commitment to fostering a positive community around your content.

- Collaborations: Partner with other creators. Collaboration can introduce your content to a wider audience, generating more visibility and engagement.

Importance of Consistent and High-Quality Content

Consistent high-quality content is the cornerstone of a successful TikTok presence. This isn’t just about posting regularly; it’s about providing valuable, entertaining, or informative content that resonates with your target audience.

High-quality content is essential for establishing a positive presence on TikTok. It demonstrates to the platform that your content is worth showcasing to a wider audience.

Potential Limitations

While recovery is possible, there are potential limitations to consider. Factors like the severity of the shadow ban, the length of time it’s been in effect, and the overall quality of your account’s history can all influence the effectiveness of your recovery strategies.

- Account Age and History: A newly created account might face more significant challenges in recovering from a shadow ban than an established one with a proven history of engagement.

- Algorithm Changes: TikTok’s algorithm is constantly evolving. What works today might not work tomorrow, requiring ongoing adaptation and monitoring of performance metrics.

- Unforeseen Circumstances: There’s always the possibility that unforeseen factors beyond your control could impede recovery efforts. A sudden drop in engagement or a shift in trends can make regaining visibility more difficult.

End of Discussion

In conclusion, TikTok shadow bans can significantly impact your account’s performance. By understanding the causes, effects, and how to detect them, you can take proactive measures to avoid a shadow ban and maintain a healthy TikTok presence. Remember, consistent high-quality content and adherence to TikTok’s community guidelines are key to avoiding this issue and ensuring your content reaches its intended audience.