Social Media Management Providers for Event Ticketing Platforms

Social media management providers for event ticketing platforms are becoming increasingly crucial for event organizers. These platforms offer a wide range of tools to promote events effectively across various social media channels. They streamline the entire process, from initial promotion to post-event engagement, making it easier for event organizers to connect with their target audience and drive ticket sales.

Understanding the features, benefits, and integration options available is key to selecting the right provider for your specific needs.

Event ticketing platforms themselves offer various features, from simple ticket sales to complex event management tools. Different platforms have different social media needs. A platform for a large music festival will have different requirements than a platform for a small local art show. This article explores the critical role social media management plays in this landscape, covering features, integration, strategies, and case studies to provide a comprehensive overview.

Introduction to Event Ticketing Platforms and Social Media Management

Event ticketing platforms have revolutionized how events are organized and managed. They offer a streamlined solution for selling tickets, managing attendee information, and facilitating event logistics. These platforms cater to a wide range of events, from concerts and conferences to festivals and workshops, providing a crucial tool for event organizers.Social media plays a critical role in the promotion and success of any event.

Effective social media strategies are essential for reaching target audiences, building anticipation, and driving ticket sales. Integrating social media management with event ticketing platforms can significantly amplify the reach and impact of event marketing campaigns.

Event Ticketing Platforms: Key Features and Functionalities

Event ticketing platforms offer a diverse range of features, typically including secure online ticketing, robust payment processing, and detailed reporting. These platforms streamline the entire process, from ticket sales and management to attendee communication and event logistics. This includes functionalities like customizable ticket types, dynamic pricing options, and integrated attendee databases.

The Role of Social Media in Event Promotion, Social media management providers for event ticketing platforms

Social media platforms are indispensable tools for event promotion. They allow event organizers to engage with potential attendees, build a community around the event, and drive ticket sales through targeted advertising and compelling content. Visual elements, such as high-quality images and videos, are often key to capturing attention and increasing engagement on platforms like Instagram and TikTok.

Importance of Social Media Management for Event Ticketing Platforms

Effective social media management is crucial for the success of event ticketing platforms. It involves creating engaging content, running targeted ads, and monitoring social media conversations to gauge public interest and address concerns promptly. A well-managed social media presence can significantly increase brand awareness, drive ticket sales, and foster a positive perception of the event. A platform’s ability to seamlessly integrate with social media tools will be key to success.

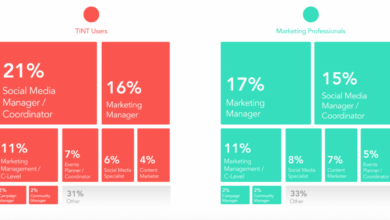

Target Audience and Social Media Habits

The target audience for event ticketing platforms is diverse, ranging from music fans and conference attendees to festivalgoers and workshop participants. Understanding their specific social media habits is critical for crafting effective marketing campaigns. For instance, music fans might be more active on platforms like Twitter and Instagram, while professionals attending conferences may use LinkedIn more frequently. Platforms need to tailor their content strategy to resonate with these distinct groups.

Comparison of Event Ticketing Platforms and Social Media Needs

| Event Ticketing Platform Type | Typical Features | Social Media Needs |

|---|---|---|

| General-purpose ticketing platforms | Wide range of event types, often with built-in marketing tools. | Broad social media presence across various platforms. Emphasis on multi-platform content creation and distribution. |

| Specialized ticketing platforms | Focus on specific event types (e.g., concerts, conferences, festivals). | Tailored social media campaigns targeting specific interests and demographics. |

| Platforms with built-in marketing tools | Integrated tools for event promotion, often including social media sharing options. | Emphasis on leveraging platform features for social media marketing. |

| Platforms with limited or no built-in social media features | May require external tools for social media integration. | Careful selection of external social media management tools and strategy development. |

This table highlights the diverse social media needs of different event ticketing platforms. A successful strategy will depend on understanding the platform’s specific functionalities and the target audience’s social media preferences. A platform’s marketing capabilities are increasingly intertwined with its social media strategy.

Features and Benefits of Social Media Management Providers for Event Ticketing

Event ticketing platforms are increasingly relying on social media to reach and engage potential attendees. Effective social media management is crucial for boosting ticket sales, building anticipation, and driving overall event success. Social media management providers offer a streamlined solution for event organizers, handling the often-complex task of managing social media presence across multiple platforms.Social media management tools for event ticketing platforms provide a centralized dashboard for managing various aspects of your social media strategy, enabling event organizers to maintain a consistent brand message, track campaign performance, and allocate resources efficiently.

They offer pre-built templates, scheduling capabilities, and analytics tools that can significantly reduce the workload and improve the overall efficiency of your event marketing campaigns.

Key Features Offered by Social Media Management Providers

Social media management tools for event ticketing platforms are designed to simplify the complexities of event promotion. These tools offer a variety of features, including social media posting scheduling, analytics dashboards, and integrated event ticketing platforms. These integrated features enable organizers to seamlessly manage event promotion across various social media channels, ensuring consistent messaging and optimized engagement. For example, some tools allow direct ticket links to be embedded in posts, enabling instant access to purchase tickets for attendees.

- Automated Posting: Pre-scheduled posts for different social media platforms, ensuring consistent updates and engagement throughout the event promotion cycle.

- Content Creation Tools: Templates and design tools for creating visually appealing graphics, event flyers, and other promotional materials, facilitating consistent branding across social media.

- Social Listening: Tools for monitoring social media conversations related to the event, allowing organizers to track feedback and address potential issues in real time.

- Analytics & Reporting: Comprehensive dashboards providing insights into campaign performance, including engagement metrics, reach, and ticket sales generated from social media activity.

- Integration with Ticketing Platforms: Seamless integration with event ticketing platforms, enabling organizers to track ticket sales directly from social media campaigns and manage event details.

Benefits of Using Social Media Management Providers for Event Organizers

Leveraging social media management tools can provide significant advantages to event organizers. These tools streamline the process of managing event promotion, freeing up valuable time and resources. Moreover, they offer powerful analytics capabilities to understand audience engagement and optimize future event campaigns. Real-world examples demonstrate that consistent, well-managed social media campaigns translate directly into increased ticket sales and improved event attendance.

Social media management providers for event ticketing platforms often handle the promotion of events, including contests. Want to boost your event’s visibility? Knowing how to run a successful Instagram giveaway or contest is key. Check out this guide for tips on maximizing engagement and reaching a wider audience: how to run an instagram giveaway or contest successfully.

These platforms can then leverage those engaged users, ensuring your ticketing platform is buzzing with activity.

- Time Savings: Automated scheduling and content creation tools reduce the time required for manual posting and social media management.

- Increased Engagement: Targeted campaigns and consistent branding through social media management tools result in higher audience engagement and interest.

- Enhanced Analytics: Detailed analytics provide actionable insights into campaign performance, enabling data-driven decisions and optimized future campaigns.

- Cost Efficiency: The tools offer efficient use of resources by reducing the need for dedicated social media staff, lowering overall costs.

- Improved Brand Consistency: These tools maintain a consistent brand message across all social media platforms, enhancing brand recognition and trust.

Comparison of Different Social Media Management Tools

Different social media management tools cater to various needs and budgets. Factors to consider include the features offered, the ease of use, and the level of customer support. Choosing the right tool depends on the specific requirements of the event and the resources available.

| Tool | Pricing Model | Key Features |

|---|---|---|

| Buffer | Various tiers based on features and user count | Scheduling, analytics, team collaboration |

| Hootsuite | Various tiers based on features and user count | Social listening, analytics, collaboration |

| Sprout Social | Various tiers based on features and user count | Social listening, analytics, influencer engagement |

Specific Functionalities for Event Ticketing on Social Media

Event ticketing platforms often require specific functionalities within social media management tools. These tools should allow for seamless integration with ticketing platforms to track ticket sales directly from social media posts. Furthermore, they should support the creation of engaging content, such as visually appealing event posters and videos, that promote ticket sales. For example, tools should allow for the embedding of ticket purchase links in social media posts.

Finding the right social media management providers for event ticketing platforms can be tricky, but understanding the broader picture of social media management is key. For example, checking out the top 12 social media management agencies services for impact, like 12 top social media management agencies services for impact , reveals valuable insights into boosting engagement and reaching the right audience.

Ultimately, these insights help event ticketing platforms leverage social media to maximize their reach and drive ticket sales.

- Direct Ticket Links: The ability to easily embed ticket purchase links in social media posts, facilitating immediate ticket purchases.

- Event Page Creation: Features that allow for the creation of dedicated event pages on social media, providing a centralized hub for event information.

- Targeted Advertising: Tools to target specific audiences with event promotions based on demographics and interests, improving the return on investment.

Integration and Functionality with Event Ticketing Platforms

Event ticketing platforms are crucial for managing events, from registration to payment processing. Integrating these platforms with social media management tools amplifies reach and engagement, creating a seamless experience for event attendees and organizers. This integration significantly streamlines the promotion process, making it easier to manage marketing efforts across various channels.Integrating social media management with event ticketing platforms brings several key advantages.

By automating tasks, organizers can focus on event strategy, content creation, and attendee engagement. This integrated approach facilitates the sharing of critical event information, enabling timely updates and promotions directly on social media.

Common Integration Methods

Event ticketing platforms and social media management tools often integrate through Application Programming Interfaces (APIs). APIs allow the exchange of data between systems, enabling automated tasks like posting event details to social media, updating ticket availability, and promoting offers. This automated sharing of data, in turn, reduces the manual effort required to manage social media campaigns. A key aspect of successful integration is ensuring data accuracy and real-time updates.

Streamlining Event Promotion

Integrations streamline the event promotion process. Event organizers can automatically post updates about event changes, ticket sales, and special offers on social media platforms, ensuring that attendees are always up-to-date. This automation also reduces the likelihood of human error in sharing information. For example, if a ticket price changes, the social media post is automatically updated, eliminating the need for manual updates on multiple platforms.

The integration also allows for more targeted advertising campaigns by leveraging attendee data from the ticketing platform.

Social media management providers for event ticketing platforms are crucial for reaching your target audience. They handle the heavy lifting, allowing you to focus on the event itself. But to really maximize your reach, consider how to grow your brand with micro influencer marketing. This approach can significantly boost your visibility and engagement, leading to more ticket sales.

Ultimately, these providers can work in tandem with influencer marketing strategies to create a truly powerful online presence for your event.

Technical Aspects of Integration

Integration often involves using APIs to facilitate data exchange. Data transfer protocols, such as secure protocols and standardized formats, are crucial for maintaining data integrity and security. The success of an integration hinges on its ability to handle large volumes of data efficiently and securely. Examples of these data protocols include JSON (JavaScript Object Notation) or XML (Extensible Markup Language) for transferring data between systems.

Leveraging Ticketing Platform Data

Event ticketing platforms collect valuable data about attendees. This data can be used to personalize social media campaigns. For instance, if a ticketing platform shows that a significant portion of attendees are interested in a particular theme, the social media campaign can be tailored to reflect that interest, increasing engagement. Similarly, data about past attendees’ preferences can be leveraged to personalize offers and promote future events.

Data analysis plays a key role in identifying patterns and trends to enhance marketing strategies.

Compatibility of Social Media Management Tools with Event Ticketing Platforms

| Social Media Management Tool | Event Ticketing Platform Compatibility |

|---|---|

| Buffer | Supports integrations with many popular platforms through API connections. |

| Hootsuite | Supports integrations with many popular platforms through API connections. |

| SproutSocial | Supports integrations with many popular platforms through API connections. |

| Later | Supports integrations with many popular platforms through API connections. |

| SocialPilot | Supports integrations with many popular platforms through API connections. |

Note: This table provides a general overview. Specific compatibility depends on the exact versions of both the social media management tool and the event ticketing platform. Consult the documentation of each platform for detailed information on supported integrations.

Strategies for Effective Social Media Management for Event Ticketing

Social media has become an indispensable tool for promoting events, and event ticketing platforms can leverage it to maximize reach and engagement. A well-structured social media strategy can significantly boost ticket sales, build brand awareness, and foster a loyal community around your events. This approach involves more than just posting updates; it necessitates a thoughtful plan that encompasses various social media channels and content formats.Effective social media management for event ticketing platforms involves understanding the nuances of each platform and tailoring content to resonate with the target audience.

This means recognizing that different platforms attract different demographics and respond to different types of content. Creating a consistent brand voice and visual identity across all platforms is critical for building brand recognition and trust.

Promoting Events on Social Media

Event promotion on social media requires a multi-faceted approach that goes beyond simple announcements. A successful strategy involves engaging content, targeted advertising, and interactive elements to foster excitement and encourage attendance. Building anticipation through pre-event teasers and behind-the-scenes glimpses of the event’s preparation is an effective way to create buzz.

Social Media Marketing Campaigns for Event Ticketing Platforms

Crafting effective social media marketing campaigns for event ticketing platforms necessitates a comprehensive understanding of the target audience and their preferences. A successful campaign typically involves a blend of promotional posts, interactive content, and targeted advertising campaigns. For instance, a campaign for a music festival could include contests for free tickets, behind-the-scenes glimpses of the artists’ preparation, and live Q&A sessions with the performers.

Content Formats for Social Media Promotion

Utilizing a variety of content formats is crucial for capturing the attention of a diverse audience. High-quality images and videos are essential, as they often resonate better than text-heavy posts. Infographics can be used to present key information concisely and visually appealingly. Live streams during the event or interviews with speakers can create a sense of immediacy and authenticity.

- High-quality images and videos: These are crucial for grabbing attention and providing a visual representation of the event. Images of past events, artist profiles, and venue views are examples of compelling visuals.

- Infographics: Presenting data like ticket prices, event schedule, or artist lineup visually can be highly engaging. Using clear and concise visuals with minimal text can increase comprehension.

- Behind-the-scenes content: Sharing glimpses into the event’s planning, backstage activities, or artist interviews can foster a sense of community and authenticity.

- Interactive elements: Polls, quizzes, and Q&A sessions can encourage audience participation and build engagement. This helps in understanding attendee interests and tailoring future events.

Analyzing Social Media Performance Data for Event Ticketing

Analyzing social media performance data is critical for understanding what’s working and what needs improvement. Key metrics like reach, engagement, click-through rates, and conversion rates can provide valuable insights. Tracking these metrics allows for continuous improvement of the strategy and campaign optimization. Monitoring hashtags used by attendees can help identify trending topics and tailor content accordingly.

Engaging Event Attendees on Social Media Platforms

Engaging event attendees on social media platforms involves creating a two-way conversation. Responding to comments and messages promptly shows attentiveness and fosters a sense of community. Utilizing social listening tools can help identify and address concerns or feedback from attendees in a timely manner. Creating opportunities for attendees to share their experiences, photos, and reviews can generate positive word-of-mouth marketing.

Case Studies and Examples of Successful Social Media Management for Event Ticketing: Social Media Management Providers For Event Ticketing Platforms

Unlocking the power of social media for event ticketing requires more than just posting updates. Successful campaigns are built on strategic planning, targeted messaging, and a deep understanding of the audience. This section explores case studies of platforms that have effectively leveraged social media to drive ticket sales, build community, and enhance brand recognition. We’ll dissect their strategies, highlight results, and draw valuable lessons from their successes.

Examples of Successful Event Ticketing Platforms Using Social Media Effectively

Event ticketing platforms are increasingly recognizing the pivotal role of social media in reaching and engaging their target audience. Successful platforms don’t just broadcast; they cultivate communities around shared interests, building anticipation and excitement for upcoming events. Their strategies often involve a mix of engaging content, interactive elements, and targeted advertising to reach specific demographics.

Strategies Employed by Successful Platforms for Social Media Marketing

Platforms employing effective social media strategies prioritize building relationships with their audience. This involves more than simply promoting events; it’s about fostering a sense of belonging and anticipation. Key strategies often include:

- Interactive Content Creation: Platforms frequently utilize polls, quizzes, and Q&A sessions to engage users and gather feedback. This creates a sense of community and provides valuable insights into audience preferences.

- Targeted Advertising Campaigns: Understanding the audience is paramount. Platforms leverage social media advertising tools to precisely target potential attendees based on demographics, interests, and past event attendance.

- Influencer Marketing: Partnering with relevant influencers in the event space can significantly amplify reach and credibility. Influencers can promote events to their engaged followers, driving a wave of interest and ticket purchases.

- Community Building Through Hashtags and Groups: Platforms utilize dedicated hashtags to create discussion forums around events, fostering anticipation and generating organic buzz. Actively engaging in relevant online communities can extend the reach of events and build brand loyalty.

- Visual Storytelling: High-quality images and videos showcasing the event atmosphere, performers, or previous attendees can effectively capture attention and build excitement.

Specific Results Achieved Through Social Media Campaigns

Quantifiable results are crucial for evaluating social media success. Platforms that effectively utilize social media often report:

- Increased Ticket Sales: A notable rise in ticket sales directly attributable to social media campaigns. This is a key indicator of campaign effectiveness.

- Enhanced Brand Awareness: Increased brand recognition and visibility within the target audience. Measured through metrics like website traffic and social media engagement.

- Improved Customer Engagement: More interactions with potential and existing attendees through comments, shares, and messages. This creates a strong community around the events.

- Higher Conversion Rates: A demonstrable increase in the percentage of social media users who ultimately purchase tickets.

- Positive Brand Sentiment: Increased positive feedback and mentions of the platform on social media. This builds a positive reputation and trust.

Lessons Learned from These Case Studies

Analyzing successful social media campaigns reveals several key takeaways:

- Consistency is Key: Regular posting and engagement are vital for maintaining audience interest and driving consistent results.

- Audience Understanding: Understanding the target audience is crucial for tailoring messaging and content for optimal impact.

- Data Analysis: Tracking key metrics and analyzing data from social media campaigns provides insights into what resonates with the audience and allows for adjustments to strategies.

- Adaptability: Social media trends evolve rapidly, so platforms must remain adaptable and responsive to changes in audience engagement and platform algorithms.

Summary of Key Takeaways from Each Case Study

| Case Study | Key Strategy | Specific Results | Lessons Learned |

|---|---|---|---|

| Example Platform A | Interactive content, targeted ads | 20% increase in ticket sales, 15% higher conversion rates | Targeted ads and interactive content are highly effective |

| Example Platform B | Influencer marketing, community building | 30% increase in brand awareness, 10% increase in positive sentiment | Influencers and community building strategies are powerful |

Future Trends and Predictions for Social Media Management in Event Ticketing

The landscape of event ticketing is rapidly evolving, and social media is at the heart of this transformation. Event organizers are increasingly relying on social media to reach wider audiences, build anticipation, and drive ticket sales. Understanding the future of social media management in this sector is crucial for success.The future of event ticketing hinges on leveraging social media’s ever-changing algorithms and features to optimize engagement.

Adapting to new trends, and effectively utilizing the latest tools and platforms, will be paramount for event organizers to stand out and maximize their return on investment.

Emerging Trends in Social Media and their Impact on Event Ticketing

Social media is constantly evolving, introducing new features and functionalities that impact how event organizers interact with their audiences. Short-form video platforms, augmented reality (AR) filters, and interactive live streaming are reshaping event marketing strategies. The rise of these technologies is prompting event organizers to integrate them into their social media campaigns to better connect with their target audience and create unique, immersive experiences.

This shift necessitates a proactive approach from social media managers to leverage these innovative tools effectively.

Predictions for the Evolution of Social Media Management in Event Ticketing

Social media management for event ticketing will become increasingly sophisticated, focusing on personalized experiences and data-driven insights. AI-powered tools will play a crucial role in automating tasks like targeted advertising, content scheduling, and audience segmentation. This automation will free up event organizers to focus on creating engaging content and building meaningful connections with their audience.

Technological Advancements and Their Influence on Future Social Media Marketing for Events

Technological advancements, particularly in the realms of virtual reality (VR) and augmented reality (AR), will reshape how events are promoted and experienced. Imagine VR tours of a festival venue, allowing potential attendees to “walk” through the space before committing to a purchase, or AR filters that let users try on outfits at a fashion show. These innovations offer opportunities to enhance the pre-event experience, building excitement and driving ticket sales.

Potential Challenges and Opportunities in This Space

While the future of social media management in event ticketing presents exciting opportunities, there are challenges to consider. The rapid pace of technological change necessitates continuous learning and adaptation. Keeping up with the latest trends and utilizing emerging technologies effectively will be key to success. Furthermore, maintaining audience engagement and relevance in a saturated online environment will require innovative strategies and creative content.

Event organizers who adapt to these changes will thrive.

Summary Table of Potential Future Trends in Event Ticketing Platforms and Social Media

| Trend | Description | Impact on Event Ticketing |

|---|---|---|

| AI-powered Social Media Management | Automated tasks, targeted advertising, and personalized content recommendations. | Increased efficiency, higher conversion rates, and enhanced customer experiences. |

| VR/AR Integration | Interactive pre-event experiences, immersive virtual tours, and interactive filters. | Enhanced engagement, improved customer experience, and higher ticket sales. |

| Short-form Video Dominance | Rise of platforms like TikTok and Instagram Reels. | Increased engagement, more creative content formats, and improved audience reach. |

| Interactive Live Streaming | Real-time Q&A sessions, virtual meet-and-greets, and behind-the-scenes content. | Enhanced audience engagement, increased interaction, and building brand loyalty. |

Epilogue

In conclusion, social media management providers are essential tools for event ticketing platforms. They offer powerful features for effective promotion and engagement, enabling organizers to reach a wider audience and boost ticket sales. Understanding the integration capabilities and pricing models is key to selecting the right provider. Choosing the right platform and utilizing the right strategies is crucial for success in today’s competitive event market.